Advancements in technology have brought a golden age for services - particularly customer service. One of the most powerful customer service tools we have today is co-browsing.

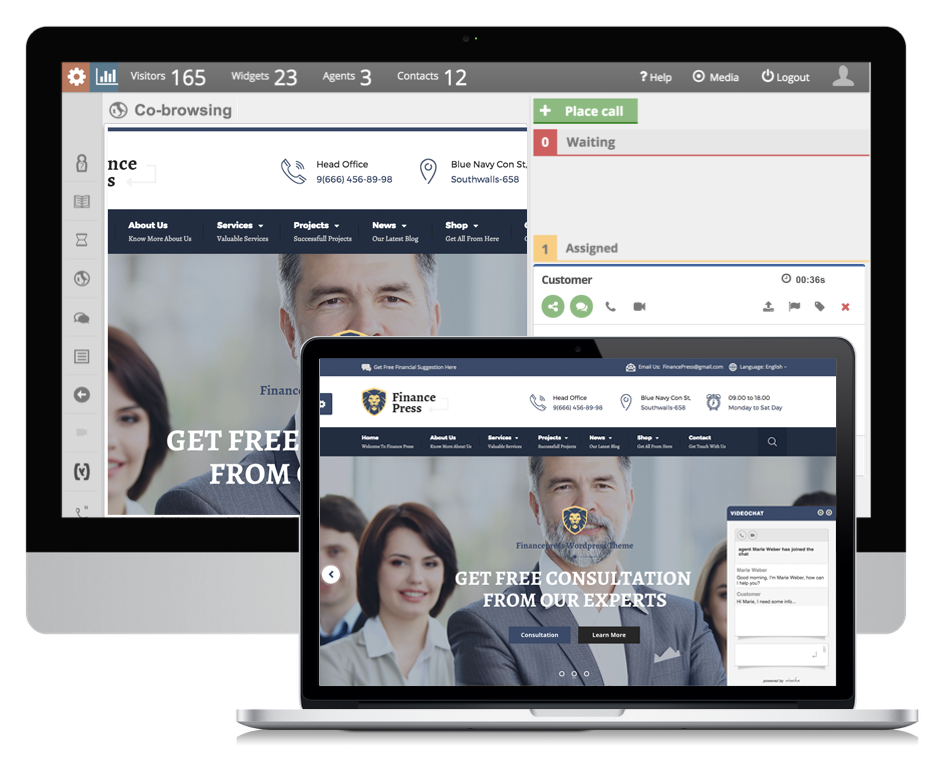

For those who are unfamiliar, co-browsing basically allows you to navigate web pages together with your customers. Applications have been quite revolutionary especially for customer service. Another closely related term is screen-sharing and is used often in video conferences or webinars.

Although co-browsing isn’t as widespread as it should be, 13.8% of companies that used co-browsing in their customer service have seen a year-on-year improvement in the number of positive social media mentions compared to just 3.4% of those who don’t use co-browsing.

To understand what it can bring to your customer service, let’s take a look at some of co-browsing benefits specifically for the banking sector:

Quick Resolution of Issues

To discuss this, we can study how innovative companies have used co-browsing to quickly resolve issues. Microsoft has been using co-browsing as a last resort to help troubleshoot operating system errors. Microsoft support staff can, with permission from those who request support, view their desktop and even take control of their mouse and keyboard to help fix issues on the spot. It basically cuts the need to physically bring computers to IT service shops.

Compare that with your basic chat or phone support. A customer with an issue will try to explain their problem. Your customer service representative will then try to explain to them how to solve the issue. If the problem is quite complex and the assisted user isn’t too tech-savvy, the problem could take time to be resolved.

Since banks have web portals for online banking, customers could be lost in the various processes. With co-browsing, banks can help customers breeze through online banking operations.

Convert More Customers

In general, online banking has allowed banks to increase the number of transactions from its customers. This is because customers are more comfortable doing business with organizations that make processes more convenient and efficient for them.

Co-browsing helps clarify customer doubts and helps increase familiarity with online banking processes. For example, let’s say there’s a visitor to your bank’s website and requested help from your online customer service representative about the best financial products or services for them. Your representatives could then use co-browsing to direct the potential customer to pages that could be interesting for them instead of risking your potential customers bounce from your site without finding the product or service they were looking for.

Increase Trust

Anything to do with money requires a large amount of trust. Banks understand that having the customer’s trust is a big factor to gaining their business.

One of the ways banks foster trust with their customers is personal interaction through their brick-and-mortar branches. Customers head to bank branches when doing trust-sensitive operations such as opening an account or applying for a loan or credit card. However, during information gathering, customers don’t go and visit banks personally. They do research on financial products and services online and make their decision after.

Imagine if you can already initiate that personal interaction when they visit your website. You no longer have to wait until they visit one of your branches. Through chat functionalities that have co-browsing capabilities, you can already start building trust with them. From giving demos on how to easily move around the online banking platform to showing off your latest budgeting application, there are many ways to convince customers that you’re the right bank for them.

Conclusion

Since the adoption of co-browsing hasn’t been widespread yet, this presents banking institutions with another way to differentiate themselves from their competition.

By becoming the bank with superior customer service with advanced capabilities such as co-browsing, this will give your organization a significant advantage in a market where customer service is an important factor.

Do you want to know more? Download free our document

Follow Us: