Mobile banking is important for giving customers on-the-go banking services wherever they are. That’s why you can’t ignore customer engagement even if you’re interacting with your customers through a mobile phone.

Mobile banking is important for giving customers on-the-go banking services wherever they are. That’s why you can’t ignore customer engagement even if you’re interacting with your customers through a mobile phone.

Vivocha, the multichannel online customer engagement platform, keeps this in mind and made sure there is an adequate focus on mobile customer engagement functionalities.

Be Everywhere: Mobile Website, Native iOS or Android Apps, Social media app like Facebook Messenger.

Vivocha includes a native software development kit (SDK) that allows you to easily integrate chat, voice, video, and support directly into iOS or Android Apps. Once you log into Vivocha, it’s only a matter of minutes to set up your on-line engagement service functionality. After customizing it, you just have to copy and paste a few lines of code to your mobile app whether it’s iOS, or Android.

You can also help customers reach you in social media, particularly in Facebook by being present in Facebook Messenger.

Interested in learning how to add Live Chat to your Website?

Click here to request a Live Demo with us!

Start The Conversation Yourself

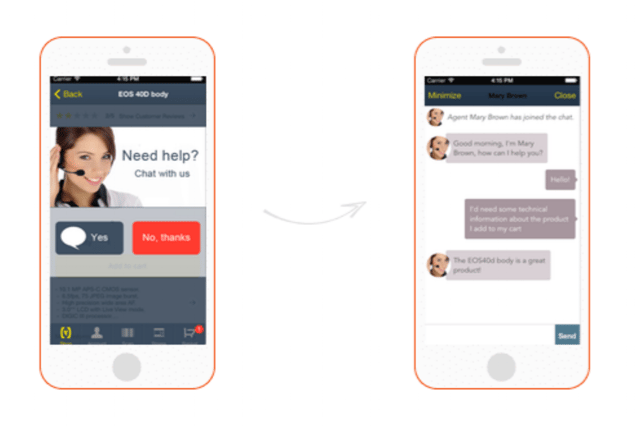

No need to wait for the customer to start the conversation and risk them from bouncing. Specific popups can be activated only when specific conditions are met. Maybe a user has been hovering over a page for a while. A pop-up chat can help speed things along by letting you start the conversation. If you need to put a particular focus on a new product, you can enable these proactive chat messages in those specific pages.

Allows Push Notifications

Even if the customer has left the app, they can still view your messages through push notifications. Each time your agent sends a message, your customer will receive an alert and they can come back to the app just by clicking it. This functionality also lowers the risk of losing contact if internet connectivity is spotty. Even if the connection fails, you can just pick up where you left off as soon as internet is restored.

Contextualizes and Frames Conversations

You can request data or information from your customers before starting an interaction so that it can automatically route conversations to the specialist agent, enhance personalization and increase chances for sales and first-contact resolution. With Vivocha’s customized data collection widgets, you can collect more useful customer data.

Boosts Capabilities With Additional Integrations

Many third party software provide additional dimensions to each customer profile. Increase your understanding of your customer by integrating them into Vivocha giving you their navigation history, technical information, geolocation, past purchases, historical interactions with support staff and more. Your agent will now be further empowered with more information about each customer by having various business software integrated into your Vivocha console.

Analyzes Mobile Interactions

With a lot of customer data being collected through Vivocha, you can get deeper insights into how your mobile customer service is performing through Vivocha’s reports. The platform includes Agent Reports and Services Reports. Agent Reports allow you to see how individual agents are performing. See their availability, interaction time, waiting time and rates of success. In the Services Reports, you can find out whether VoIP or chat delivers more success.

Aside from a bird’s-eye-view of your mobile customer service, you can also drill down into individual interactions through the Transcript Analysis that will give you insightful data such as chat time, pages accessed, handling agent, message transcript and more.

Conclusion

There’s no need to sacrifice personalized interactions in mobile banking. As you’ve seen through Vivocha, you can recreate the same level of personalized customer service in mobile apps, social media or in your mobile website allowing you to deliver superior customer service both online and offline.

Follow Us: